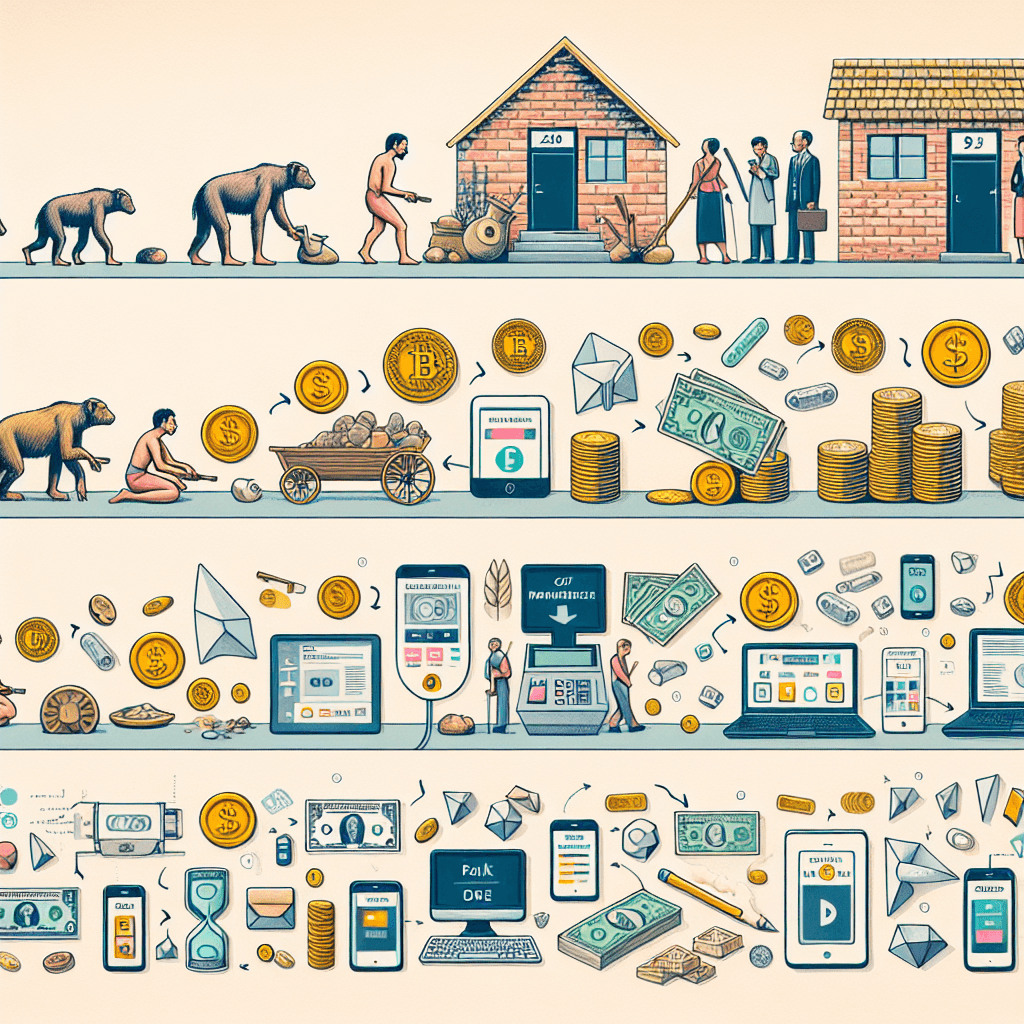

Evolution of Financial Systems from Past to Present

Inquiry Framework

Question Framework

Driving Question

The overarching question that guides the entire project.How have financial systems evolved across different cultures and historical events, and what role have banks and other institutions played in shaping global economies?Essential Questions

Supporting questions that break down major concepts.- How have financial systems evolved throughout history?

- What role have banks played in the development of global economies?

- In what ways have significant historical events influenced financial systems?

- How do different cultures and societies manage finances historically?

- What are the challenges and benefits of different financial systems throughout history?

Standards & Learning Goals

Learning Goals

By the end of this project, students will be able to:- Analyze the evolution of financial systems across different cultures and historical events.

- Evaluate the role of banks and other financial institutions in shaping global economies.

- Understand the influence of significant historical events on financial systems.

- Compare and contrast how various cultures manage and structure their financial systems.

- Identify the challenges and benefits associated with different historical financial systems.

Common Core Standards

Economics Standards

Next Generation Science Standards

Entry Events

Events that will be used to introduce the project to studentsThe Financial Time Capsule

Students are presented with a mysterious 'financial time capsule' from a past decade, filled with banknotes, coins, receipts, stock market snippets, and household budgets. Their curiosity is piqued to investigate the financial trends and economic events of that era, challenging students to reflect on how these historical financial situations relate to today's economy and personal finance choices.Personal Finance Diary Through Ages

Students are asked to create a 'personal finance diary' as if they were individuals from different historical periods. This personalizes historical financial data, prompting them to think critically about financial priorities, challenges, and strategies across centuries, bridging historic finance with modern-day financial literacy.Portfolio Activities

Portfolio Activities

These activities progressively build towards your learning goals, with each submission contributing to the student's final portfolio.Time Capsule Exploration

Students will explore a provided financial time capsule, analyzing its contents to identify and research historical financial trends from the specified decade. They will use their findings to relate these trends to modern economic practices.Steps

Here is some basic scaffolding to help students complete the activity.Final Product

What students will submit as the final product of the activityA research summary detailing historical financial trends and their relation to modern financial systems.Alignment

How this activity aligns with the learning objectives & standardsCovers CCSS.ELA-LITERACY.RH.11-12.1 by requiring analysis of historical financial sources.Historical Finance Diary

Students will create a personal finance diary for an individual living in a different historical period, encapsulating their financial challenges and strategies. This exercise helps to contextualize financial data within personal experiences and historical context.Steps

Here is some basic scaffolding to help students complete the activity.Final Product

What students will submit as the final product of the activityA fictional personal finance diary from a historical perspective, highlighting financial priorities and challenges.Alignment

How this activity aligns with the learning objectives & standardsAligns with CCSS.ELA-LITERACY.RH.11-12.2 by determining central economic ideas of historical periods through personal narratives.Rubric & Reflection

Portfolio Rubric

Grading criteria for assessing the overall project portfolioHistorical Financial Systems Analysis Rubric

Analytical Skills

Students' ability to critically analyze financial systems, including synthesizing historical data and trends.Historical Analysis

Assessing how well students analyze the evolution of financial systems within specific historical contexts.

Exemplary

4 PointsDemonstrates sophisticated analysis of financial systems, effectively synthesizing complex historical data to uncover insightful trends and patterns.

Proficient

3 PointsEffectively analyzes financial systems, synthesizing data to identify clear trends and patterns.

Developing

2 PointsShows emerging analytical skills, with some synthesis of data and identification of trends.

Beginning

1 PointsStruggles to analyze financial systems, with limited data synthesis and trend identification.

Contextual Understanding

Evaluating how well students integrate economic and cultural contexts into their analysis.

Exemplary

4 PointsExemplary integration of economic and cultural contexts, providing a nuanced understanding of their impact on financial systems.

Proficient

3 PointsIntegrates economic and cultural contexts effectively, demonstrating a clear understanding of their influence.

Developing

2 PointsDisplays partial integration of contexts, with basic understanding of their influence on financial systems.

Beginning

1 PointsLimited integration of economic and cultural contexts, demonstrating minimal understanding.

Research Skills and Documentation

Assessment of students' ability to conduct thorough research and document findings accurately.Research Depth

The extent of research conducted, focusing on primary and secondary sources.

Exemplary

4 PointsConducts comprehensive research using a variety of primary and secondary sources, demonstrating depth of understanding.

Proficient

3 PointsConducts thorough research with a good range of sources, demonstrating solid understanding.

Developing

2 PointsConducts basic research with limited sources, showing some understanding.

Beginning

1 PointsConducts minimal research, relying on few sources, with limited understanding.

Documentation and Citation

Accuracy in documenting research findings and citing sources appropriately.

Exemplary

4 PointsExceptionally accurate documentation of research with correct and thorough source citations.

Proficient

3 PointsAccurate documentation with correct source citations.

Developing

2 PointsBasic documentation, with some errors in source citations.

Beginning

1 PointsInadequate documentation, with frequent errors in source citations.

Creativity and Originality

Evaluation of creativity and originality in presenting historical financial information.Innovative Presentation

Creativity in the presentation of historical financial analysis or narratives.

Exemplary

4 PointsPresents analysis with exceptional creativity and uniqueness, engaging the audience effectively.

Proficient

3 PointsPresents analysis creatively, engaging the audience effectively.

Developing

2 PointsDisplays some creativity in analysis, with limited audience engagement.

Beginning

1 PointsMinimal creativity in presentation, with little audience engagement.